T. Paying Taxes

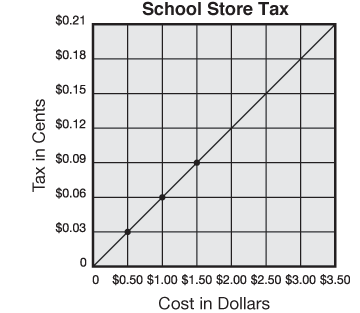

Daniel and Maria work in the school store. They charge 6¢ tax on every dollar a student spends at the store. This is how the tax works:

If the amount is 50¢, the tax is $0.03. The cost is 53¢.

If the amount is $1.00, the tax is $0.06. The cost is $1.06.

If the amount is $1.50, the tax is $0.09. The cost is $1.59.

They use a graph to find the tax on different amounts.

Use a variety of strategies to solve these problems.

- The price of a notebook is $3.00. What is the tax?

- Carmen bought paper. The price was $4.50. How much tax did she pay?

- Otis bought pencils. The price before tax was $2.50. How much did he pay altogether for the pencils and the tax?

- Jim paid 12¢ in tax when he bought markers. What was the price of the markers before tax? With tax?

- Brandy paid a total of $3.71 for pens and the tax. What was the price of the pens?

- Jonah bought paper for $2.25 and erasers for $1.75. What was his total including tax?